Reference

This GL interface relates to the Debtors Transactions fields in the Config GL Interface screen – see "Edit - General Ledger Config - Distribution Interface".

Apart from sales and customer invoicing, there are several other transactions that affect customer accounts. These transactions include debtor payments, journals and handwritten invoices.

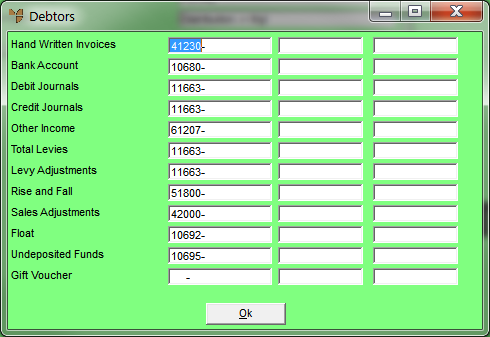

You use the Debtors screen to setup your GL interface (integration table) for these other MDS debtor transactions so that financial data is transferred automatically to the correct accounts in MGL.

|

|

|

Reference This GL interface relates to the Debtors Transactions fields in the Config GL Interface screen – see "Edit - General Ledger Config - Distribution Interface". |

To setup your GL interface for debtor transactions:

Refer to "Adding a New GL Interface Record" or "Updating a GL Interface Record".

Micronet displays the Debtors screen.

|

|

Field |

Value |

|---|---|---|

|

|

Hand Written Invoices |

Enter the GL account that represents invoice transactions that do not relate to the sale of items. This facility can be used to enter opening balances or for service type invoices that are complementary to the main source of operating income (sales). Hand Written Invoices can be found in the Debtors Transactions Processing program in MDS. |

|

|

|

Technical Tip The two fields next to each field on this screen are for entry of T1 and T2 accounts. If your company uses T accounts to flag transactions for GL reporting, enter the default T1 account for the GL account in the first field and the default T2 account for the GL account in the second field. You can also press spacebar then Enter to select these T accounts. For more information about T accounts, see "T Accounts". |

|

|

Bank Account |

Enter the GL account for the receipt and deposit of debtors (customer) payments to the Bank account. |

|

|

|

Technical Tip

|

|

|

Debit Journals |

If you are not using GL dissection in your integration (see "MDS Integration Procedure"), all journals for debtors are transferred to a central clearing account for dissection at a later time. The Journal Clearing Account in the Current Assets section of the Balance Sheet captures these transactions for reclassification and transfer by manual GL journal. Alternatively, you can set this field to a specific GL account such as Sales Adjustments. This account increases the outstanding value of a customer's account and can be posted from the Debtors Transaction Processing program in MDS. |

|

|

Credit Journals |

If you are not using GL dissection in your integration (see "MDS Integration Procedure"), all journals for debtors are transferred to a central clearing account for dissection at a later time. The Journal Clearing Account in the Current Assets section of the Balance Sheet captures these transactions for reclassification and transfer by manual GL journal. Alternatively, you can set this field to a specific GL Account such as Sales Adjustments or Bad Debts, etc. This account decreases the outstanding value of a customer's account and can be posted from the Debtors Transaction Processing program in MDS. |

|

|

Other Income |

Enter the GL account that represents the extra charges that can be added to a sales invoice. These amounts can be transferred to Sales or another GL account in the Other Income section of the Chart of Accounts. |

|

Total Levies |

Levies relate to charges applied by some non-profit organisations. An additional percentage amount is calculated on top of sales invoices which thus increases their value. If Levies are enabled, these amounts should appear in the Revenue section of the Profit & Loss statement - either in Sales or Other Income. If Levies are disabled, you can leave this field blank or set it to Journal Clearing Account in the Current Assets section of the Balance Sheet. If a user enters levies, the Journal Clearing Account captures these entries so they can be rapidly identified and corrected. Levies are setup (and enabled or disabled) within the discount matrix of MDS – see "File - Discount Matrix". |

|

|

Levy Adjustments |

Levy adjustments relate to adjustments made to levy amounts over and above a sales invoice value. These amounts should appear in the Revenue section of the Profit & Loss statement – either in Sales or Other Income. If Levies are disabled, you can leave this field blank or set it to a Journal Clearing Account in the Current Assets section of the Balance Sheet. |

|

|

Rise and Fall |

Where multi-currency debtors have been enabled, foreign exchange variations between payments and invoices are calculated in the Debtor Payments program of Debtors Transaction Processing in MDS. Enter the GL account which accumulates these transactions and reflects them in the Profit & Loss of the General Ledger. |

|

|

Sales Adjustments |

Enter the GL account that captures transactions relating to customer discounts or debtor journals that affect the balance of GST Paid. Sales adjustments are usually transactions such as on time discounts, price adjustments or the write off of bad debts. |

|

|

Float |

Enter the GL account where floats are accounted for in the General Ledger. This Float GL account should be setup as an Asset. |

|

|

Undeposited Funds |

Enter the GL account that captures manual payment types. |

|

|

|

Technical Tip

|

|

|

Gift Voucher |

Enter the GL account that captures gift voucher transactions. |

Micronet redisplays the Change GL Interface screen.